Taxes can be daunting. Here is a walkthrough of the tax return process so you feel comfortable about what, when and how to provide documents + what to expect when the tax return is complete.

If you have any questions, I’m just an email away.

- Kelli

the process

- 1 -

gathering information

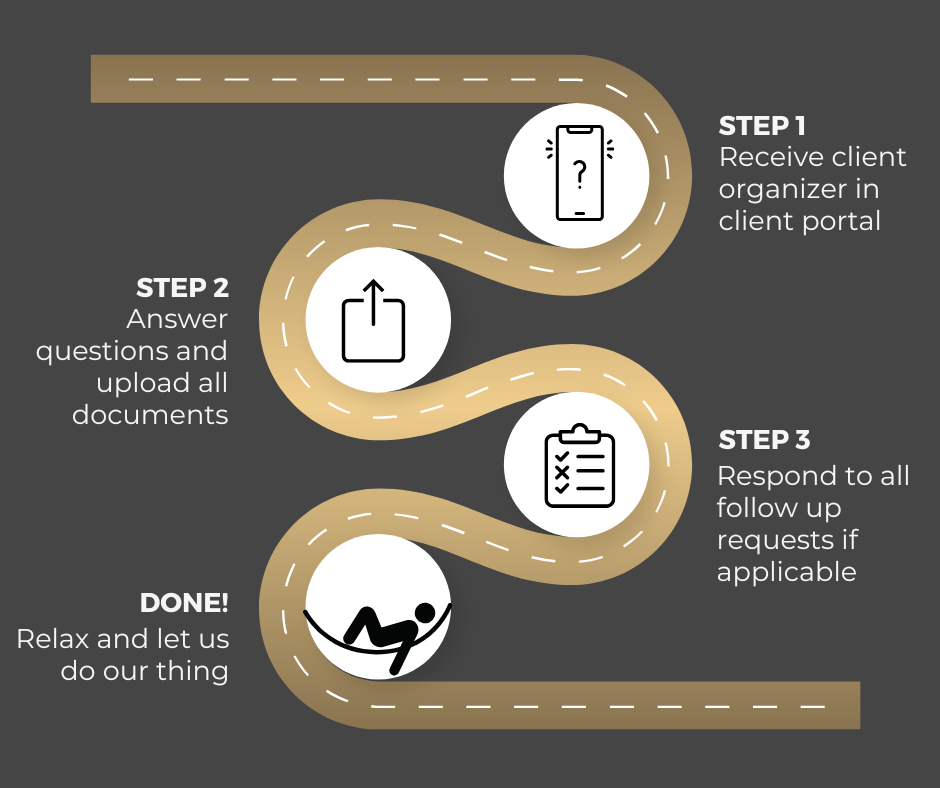

You’ll be receiving an invitation to complete your organizer. This is where you do some work. It’s important to provide everything you have at one time and be as thorough as possible to have a smooth process with minimal back and forth.

Once you complete the organizer we’ll be notified you are ready for us to review your information. We’ll follow up if we are still missing info and will begin preparation once everything is provided.

- 2 -

i do my thing

When we receive all your documents your “start date” officially begins and is added to the queue for prep and review.

This is where you wait on me and my team. You may receive some questions, but ideally we’ll have all we need and will be moving through our internal process.

We’ll be reviewing your numbers, calculating your return and reviewing for perfection and opportunities.

- 3 -

delivery + invoice + efile

When I’m done you’ll receive a few emails requesting payment and letting you know that the tax return is ready for you to view and download securely.

Once you’re happy with your return you’ll be able to e-sign it. You’ll also have next steps to pay taxes online if applicable.

The above will trigger me to efile your return and you’ll receive a confirmation email letting you know once its complete!

gathering information

Here is a break down of what gathering information looks like. You will receive emails for these steps and you can also log into your portal at any time to see if you have any tasks we are waiting on.

If you have an S Corp or Partnership return, you’ll be able to complete these steps for all your returns within the same portal.

the timeline

* estimated timeline subject to change

dates to know

expectations

uploading information

You’ll be using the tax organizer to answer questions and upload documents. All sensitive information should be sent via taxdome upload as email is not secure.

response time

During tax season I aim to respond within 72 hours to emails with questions.

payment policy

I require full payment prior to viewing and signing your return. Invoices are due upon receipt and late fees will apply.

FAQS

what is an organizer?

An organizer (formerly known as “questionnaire + request list”) is a fillable auto-saved form for you to provide all your tax info to me. This simple tool is used to help you gather information, answer relevant questions and organize what is needed for us to complete your return. Submitting the organizer in the portal is what tells us you are ready for us to get started!

what if I have both a entity (S corp or Partnership) return and a personal return?

You will have an organizer in your client portal for both your entity and personal return as a task to complete. These tasks are super organized in your portal since you can toggle between accounts in the lower left corner (one for personal and one for each separate business filing). I do request you prioritize your business returns requests first as they are due sooner (3/15).

what if I already know I need to extend?

That’s fine! Just send me an email letting me know. We’ll file the extension and follow up with you outside of tax season. Please note that extended tax returns will not be filed until after mid June.

where do I make payments

I created a payment page for you to be able to make tax and estimated tax payments for federal and states.

how will you know I’m ready to file my tax return?

In order for me to be notified you’re ready to file you need to submit the tax return organizer, this will put you in my queue.

where can I upload information securely to you?

All clients will have access to their client portal and will be a user in my system. This allows you to upload documents to me and eventually you’ll have copies of your final tax returns here. You can view what you’ve already provided and you may also receive request items via taxdome as well with steps on how to upload.